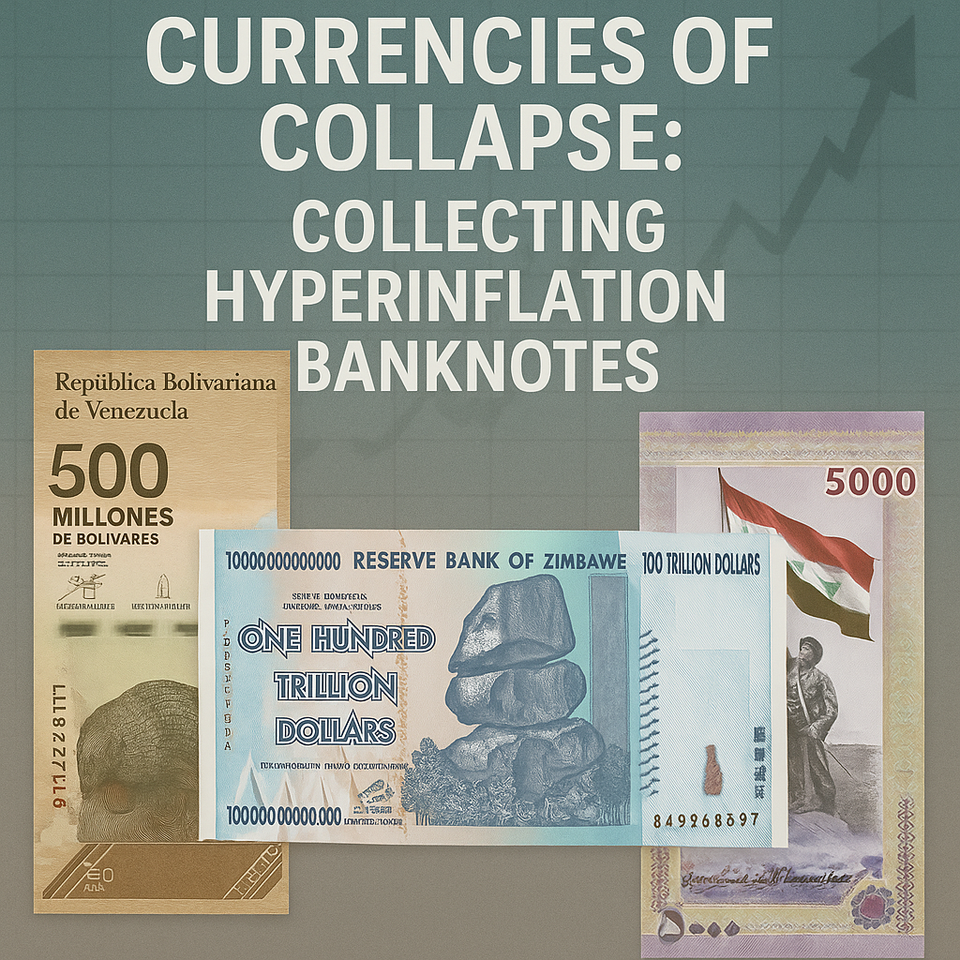

Hyperinflation Banknotes: Venezuela, Zimbabwe, Iran, Syria, Hungary, Iraq, and Vietnam

Hyperinflation – extreme, runaway inflation – leaves a dramatic paper trail in the form of banknotes with astonishing denominations. Countries that suffered hyperinflation (or high inflation verging on it) have issued currency in eye-watering figures: trillions, billions, or millions in local units. The images and denominations on these notes speak volumes about the financial instability and social chaos that accompanied their issuance. This article explores notable high-denomination banknotes from Venezuela, Zimbabwe, Iran, Syria, Hungary, Iraq, and Vietnam – focusing on those released during peak inflationary periods – and examines their denominations, issue dates, designs, historical context, and collector value. These banknotes, born of economic chaos, have since become fascinating collectibles and historical artifacts.

Venezuela: Bolívares Digitales in the Millions

Venezuela’s struggle with hyperinflation in the 2010s and early 2020s forced multiple currency redenominations. In October 2021, the bolívar digital (VED) replaced the bolívar soberano, lopping off six zeros. Yet inflation persisted, and by 2023 the highest note was 100 VED (equivalent to 100 million pre-redenomination bolívares). In August 2024, the Central Bank introduced 200 and 500 bolívar notes to keep up with soaring price levels.

The newly issued 500 VED note – amounting to 500 million of the previous currency – is a vivid testament to the nation’s ongoing economic challenges. First released in late 2023, this note quickly became emblematic of Venezuela’s plight, as denominations in the hundreds of millions (old value) became commonplace. Despite several efforts to stabilize the currency, inflationary pressures remain deeply entrenched in the Venezuelan economy.

Design & Features: The 500 VED note features the “Trilogy of the Liberator” – three portraits of national hero Simón Bolívar – radiant sun patterns, and a map of Venezuela. The reverse commemorates the Naval Battle of Lake Maracaibo and depicts the Rafael Urdaneta Bridge. Security features include a 2 mm-wide windowed security thread, a watermark of Bolívar, microprinting, and a holographic stripe. The note’s vibrant colors and vertical format highlight modern design despite the crisis it represents. The printing quality remains high despite financial constraints.

Historical Context: Venezuela’s hyperinflation peaked in the late 2010s, with the currency devaluing rapidly. The introduction of the 500 VED note in 2023/24 – only two years after a six-zero redenomination – underscores how inflation continues to erode currency value. Inflation between 2016 and 2019 alone reached tens of millions of percent. As of mid-2025, inflation remains high, and the bolívar continues to slide. There is speculation that another redenomination or further dollarization may be necessary. Analysts project that if current inflation trends persist, Venezuela could be forced to introduce higher notes or transition fully to U.S. dollars.

Collector Value: The 500 bolívar digital note is highly coveted by collectors, especially in uncirculated and sequential-number sets. Despite a face value of a few dollars, these notes often sell at a premium due to their historical context, striking design, and symbolic representation of Venezuela’s economic turbulence. Complete sets of hyperinflation-era bolívares are also in demand, with some collectors seeking to preserve a complete chronology of redenominations.

Zimbabwe: Trillion-Dollar Bills and Record Inflation

Zimbabwe’s hyperinflation peaked in the late 2000s. By 2008, inflation was so out of control that prices were doubling almost daily. The Reserve Bank responded by printing denominations into the trillions. The $100 trillion note – released in January 2009 – remains the highest denomination ever issued for legal tender in recorded history.

Design & Features: The $100 trillion note showcases the Chiremba Balancing Rocks, Victoria Falls, and an African buffalo. Printed in shades of blue and purple, the note includes minimal security features and basic anti-counterfeit design. The massive numeric display on the face of the note remains one of the most striking visuals in world currency.

Historical Context: Zimbabwe’s inflation reached an estimated 79.6 billion percent month-on-month in late 2008. The 100 trillion note was part of the final batch before the country abandoned its currency. The currency was re-based three times, removing a total of 25 zeros. In 2019, a new Zimbabwe dollar was introduced, with inflation returning in recent years. The current highest denomination is $100 ZWL, worth less than US$1. To fight inflation, the government is relying on tight monetary policy and gold-backed digital tokens. Economists fear that if structural reforms do not hold, Zimbabwe could again edge toward severe inflation by the end of the decade.

Collector Value: Zimbabwe’s trillion-dollar notes, especially the $100 trillion, are among the most iconic symbols of hyperinflation. These notes often sell for over $100 in uncirculated condition. Full packs of 100 notes can reach thousands of dollars, especially with AA prefix serials. They are widely recognized among collectors and are often featured in museum displays as modern relics of economic collapse.

Iran: Millions of Rials and the Quest to Revalue

Iran has battled high inflation for decades. To ease cash transactions, the Central Bank has issued “Iran Cheques” – high-value bearer notes. The most recent is the 2,000,000 rial note, issued in 2023 and often referred to as "200 Toman," anticipating a currency revaluation.

Design & Features: The note features the Imam Reza Shrine and Persian calligraphy. Security features include color-shifting inks, windowed threads, and a watermark of poet Ferdowsi. Though technically not legal tender, these cheques are widely accepted. The visual design is meant to evoke national pride and cultural identity amid economic challenges.

Historical Context: Iran plans to cut four zeros from its currency and adopt the toman as its new standard (10,000 IRR = 1 toman). This gradual process is reflected in the new high-value notes. Inflation remains high, and the rial continues to lose value. As of early 2025, the exchange rate exceeds 1,000,000 IRR per USD. Projections suggest the redenomination could take full effect by 2026–2027 if political conditions remain stable.

Collector Value: The 2M rial note, along with earlier 500k and 1M versions, is sought after in uncirculated form. Sets of five can sell for hundreds of dollars, partly due to sanctions making them difficult to acquire. Their relevance is expected to grow as they may become short-lived once the redenomination finalizes.

Syria: 5,000 Pound Note – Coping with War and Inflation

Years of war and sanctions have devastated Syria’s economy. After years of denying a higher denomination was needed, the Central Bank issued the 5,000 pound note in January 2021 (printed in 2019).

Design & Features: The obverse features a Syrian soldier raising the flag. The reverse depicts the Parliament building and Temple of Palmyra fresco. Security features include watermark, segmented thread, and color-shifting ink. The note symbolizes resilience and national unity in the face of conflict.

Historical Context: Syria’s currency plummeted from 47 SYP/USD in 2011 to over 10,000 SYP/USD by 2024. The 5,000 note was introduced to replace worn smaller notes and enable high-value transactions. Some analysts worry that a 10,000-pound note may follow if inflation continues. Given the continued devaluation and absence of economic reform, projections suggest a higher denomination could emerge by 2026 unless stabilization policies are adopted.

Collector Value: These notes are common in circulation but are sold in UNC bundles. Collectors value them for their symbolism and as part of Middle Eastern hyperinflation sets. As Syria’s situation evolves, notes like the 5,000 pound may gain retrospective importance.

Hungary: 1946 Pengo – The World’s Highest Denomination

Hungary holds the record for the highest inflation ever. In 1946, prices were doubling every 15 hours. The government printed notes like the 100,000 B-pengő – equivalent to 100 quintillion pengő.

Design & Features: A peasant woman with a scythe decorates the front; the reverse includes floral patterns and the massive denomination. Printed in green-blue with minimal security features. The scale of these notes makes them mathematical marvels and educational tools.

Historical Context: The pengő hyperinflation ended in August 1946 when the forint replaced the pengő at a rate of 400 octillion pengő = 1 forint. Inflation reached 10^16% per month. Hungary’s experience is often cited in economic literature as a model of runaway inflation and its aftermath.

Collector Value: These notes are prized in UNC condition. The 100,000 B-pengő is a cornerstone of any hyperinflation collection, with prices reaching hundreds of dollars. They are sought not only for rarity but for their role in financial history.

Iraq: High Denominations Amid Postwar Inflation

Following conflict and inflation, Iraq introduced a 50,000 dinar note in 2015 to reduce the volume of cash transactions and modernize its currency system.

Design & Features: The obverse includes Euphrates water wheels and Kurdistan waterfalls; the reverse shows marshland fishermen. The note is printed on hybrid substrate with strong anti-counterfeit measures. It reflects cultural unity across Iraq’s diverse regions.

Historical Context: While not hyperinflationary, Iraq’s inflation eroded currency value over decades. The 50k note remains the highest denomination as of 2025. There has been discussion about redenominating by removing three zeros. Experts believe that such a reform may materialize in the coming years as economic conditions stabilize post-conflict.

Collector Value: Iraqi dinars, especially the 50k, are collected both for design and speculation. UNC examples retail around $60–$90. While commonly available, their numismatic value may rise if future redenomination renders them obsolete.

Vietnam: 500,000 Đồng – High Value, Low Worth

Though Vietnam avoided hyperinflation, the đồng has suffered long-term depreciation. The 500,000 đồng note, introduced in 2003, remains the country’s highest denomination.

Design & Features: The note features Ho Chi Minh and his Kim Liên village home. Printed on polymer, it includes transparent windows, latent images, and a color-shifting thread. Its durability and national symbolism contribute to its popularity.

Historical Context: Inflation in the 1980s–90s led to larger notes. The đồng has stabilized since the 2000s, but large denominations remain due to the currency’s low value. Vietnam has discussed dropping zeros, but there is no urgent political will to act. Continued economic growth may eventually allow such reform.

Collector Value: Widely circulated, the 500,000₫ note is a popular souvenir and appears in high denomination sets. Uncirculated examples carry slight premiums. These notes are also used in comparative currency displays to illustrate purchasing power globally.

Conclusion: From Hyperinflation to Collectibles

Each of these banknotes – Venezuelan bolívares, Zimbabwean trillions, Iranian mega-rials, Syrian pounds, Hungarian pengő, Iraqi dinars, and Vietnamese đồng – tells a story of inflation and economic adaptation. Some nations continue to struggle (Venezuela, Syria, Iran), while others have stabilized (Vietnam, Iraq). Hungary remains the worst-case historical example, and Zimbabwe the most famous modern case.

Collectors are drawn to these notes not just for their design but for the cautionary tales they represent. Whether issued from desperation, reform, or commemoration, these currencies serve as tangible records of how economies can spiral – and sometimes recover. Holding a trillion-dollar bill or a 100-quintillion-pengő note is not just a novelty; it’s holding a lesson in monetary history. As the global economy continues to evolve, these currencies stand as enduring warnings against unchecked monetary expansion.

Key Hyperinflation Highlights:

-

Venezuela’s inflation between 2016–2019: estimated in tens of millions of percent.

-

Zimbabwe’s peak monthly inflation in 2008: ~79.6 billion percent.

-

Zimbabwe’s annualized inflation late 2008: ~8.97 × 10^22%.

-

Hungary’s monthly inflation in 1946: ~10^16%.

-

Iran projected to lop four zeros from the rial and adopt the toman.

-

Syria may face future 10,000-pound issues if current inflation persists.

-

Iraq has discussed redenominating its dinar to cut zeros.

-

Vietnam has stabilized but still uses large denominations due to past inflation.

Projection:

-

Venezuela and Iran are the most likely to undergo further redenominations by 2026.

-

Zimbabwe is unlikely to reintroduce ultra-high notes but inflation risk remains.

-

Syria may eventually introduce a higher denomination if the economy doesn’t stabilize.

-

Hungary, Iraq, and Vietnam demonstrate that inflation, even when curbed, leaves a lasting legacy on currency design and denomination size.

-

Global collectors will continue to see these notes not only as historical records but as powerful educational tools on monetary policy and fiscal responsibility.

Explore Popular Articles

Paper Vs. Gold

Paper vs. Gold The Liquidity Ratio of Numismatics The global financial architecture has undergone a...

Iran Update

The Iran Liquidity Freeze Why the 5 Million Rial Note is Vanishing The global financial landscape o...

The Texas Trophy

The Numismatic Genesis of Freestone County A Comprehensive Analysis of the Serial Number 1 Teague N...